Dhaka Bank Expands International Remittance Services Via SWIFT

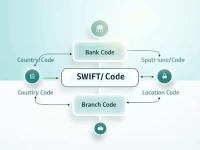

The SWIFT code for DHAKA BANK PLC. is DHBLBDDH107, making it ideal for international remittances. This code ensures that funds are accurately transferred to the bank branch in Dhaka, preventing transaction errors. Familiarity with SWIFT codes is vital for both individual and corporate clients to ensure the safety of funds in cross-border transactions.